Auto Insurance FAQs

Auto Insurance FAQs

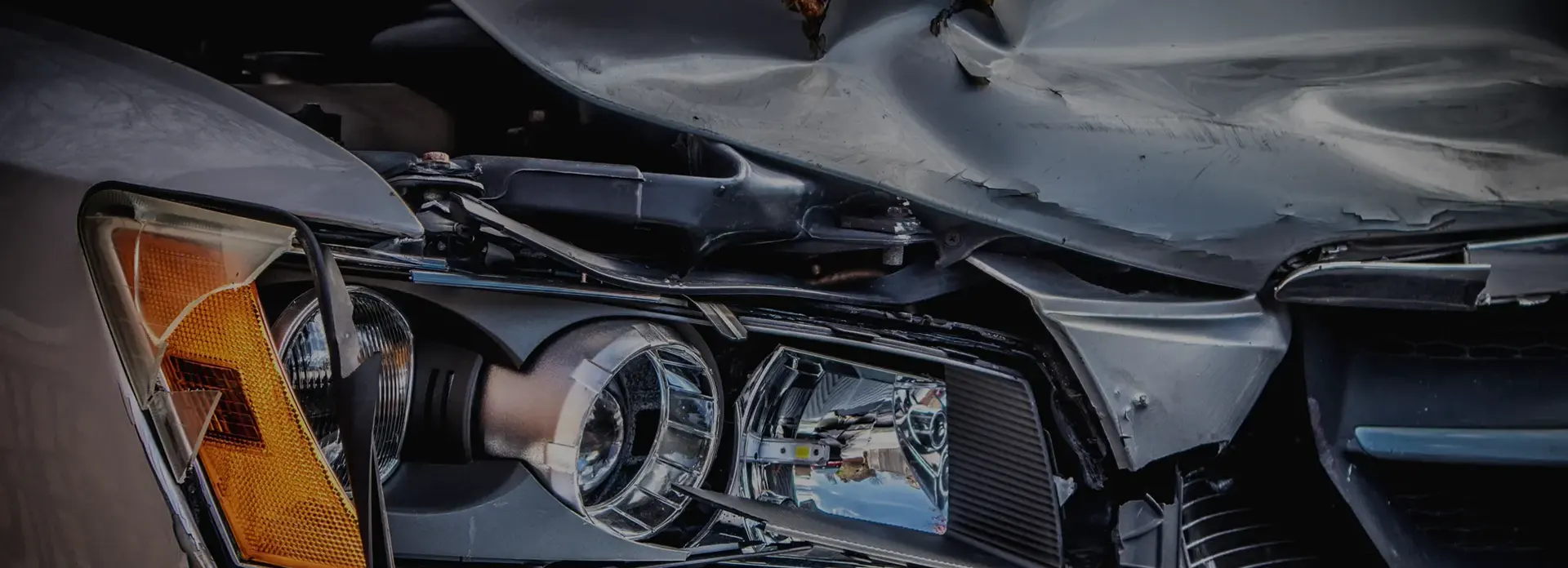

Dealing with the stress of a collision is hard enough without trying to figure out how your accident insurance works. Here are some answers to frequently-asked questions about insurance policies.

Will the insurance company guarantee your work?

We guarantee our own work, but the insurance company does not have the legal right to guarantee a third party's work.

Who pays for repairs?

It depends on the circumstances. If you were at fault, but have comprehensive or collision insurance, the insurance company would pay the costs minus your deductible. If the other party was at fault, their insurance company should pay.

Do I have to accept the insurance company's appraisal of damage?

No. Check the "Appraisal Clause" in your policy if you have differences with their appraisal. It allows you and the insurance company to gather an opinion from an appraiser you both agree upon, or a third-party "Umpire" if you cannot agree.

Do I have the right to a rental car?

If you have purchased rental car coverage and were not responsible for the accident, you may seek reimbursement from the insurance company or, if another driver was responsible for the accident, their insurance company. If you do not have rental car coverage and were responsible for the accident, you have no grounds to ask for reimbursement. If the other driver was liable, you can generally seek reimbursement from their insurance company.

Who do I call to file a claim?

Reach out to your agent or insurance provider. If someone else is liable for your damages, it's essential to also get in touch with their insurance agent or company. The assigned adjuster will then guide you on any further necessary actions.

What does my policy require me to do after an accident?

Inform your insurance provider about the accident's details, including the time, location, and circumstances of the incident. Provide the names and addresses of individuals injured in the accident as well as any potential witnesses. Collaborate fully with the investigation process. Lastly, acquire or grant authorization for your insurance company to secure necessary documents, medical records, and relevant information.

Want more information on your rights? To make an appointment, call us at 682-521-9211 or make an appointment online!